Digital marketing in the financial industry involves using strategies and tactics by financial institutions and services to promote their offerings, engage clients, and expand their customer base through digital channels. Financial services, including banking, insurance, investment firms, and fintech companies, leverage various online platforms such as social media, email, content marketing, and others to connect with potential clients and establish strong, enduring relationships. Effective finance digital marketing helps institutions reach their target audience and build trust and credibility, which is essential in a field where consumers prioritize security and reliability.

According to Sales Lead Automation statistics, acquiring leads in financial services typically costs around $160 each. Although customers in this field usually have high lifetime values, the marketing costs are significant, which makes choosing the right strategy crucial. This article sheds light on various aspects of digital marketing for financial services. Reading further, you can explore key tactics and best practices and learn how institutions can leverage digital tools to stay competitive and meet their clients’ needs.

Let’s dive in!

What Is Digital Marketing in Finance?

Digital marketing in finance is similar to online marketing in other branches – it leverages various strategies, such as content marketing, email marketing, or PPC, to promote financial services, engage with clients, and attract new customers. Yet, financial institutions’ success relies on reliability, so their digital marketing efforts focus not only on attracting new customers but also on building trust and credibility.

Carefully chosen and well-executed strategies allow banks, investment firms, insurance companies, and fintech startups to effectively reach their target audiences, communicate their value propositions, and drive customer acquisition and retention. Digital marketing also allows financial companies to provide transparent information about their services through various channels, enabling them to address customer questions, showcase their expertise, and highlight their unique services.

How to Create a Digital Marketing Strategy for Financial Services?

To create effective digital marketing strategies for financial services, it’s essential to clearly define campaign goals, understand the target audiences‘ needs, and stick to a structured approach that considers the industry’s unique needs.

To align your strategy with measurable outcomes that support your institution’s growth, you must first set a goal, such as increasing website traffic or capturing qualified sales leads. You also have to create a portrait of the ideal customer so you can easily match your offer to resonate with your audience. These two basic steps let you choose the right digital marketing channels and create effective, targeted campaigns.

Then, you can consider your marketing strategy, sticking to the following steps:

Develop a Content Marketing Plan

The right content strategy is a critical component of online marketing in the finance sector, as clients seek trustworthy information rather than just catchy and attractive offers. You should craft content that addresses common financial questions, educates your audience, and demonstrates your expertise. To attract users, provide value, and build your brand’s credibility, leverage blog posts, videos, white papers, and webinars. Moreover, ensure the content you share on your website and landing pages is optimized for SEO to improve visibility in search engines.

Leverage Social Media and Paid Advertising

Social media platforms like LinkedIn, Facebook, or X are valuable online marketing channels, enabling businesses to connect with clients and share content. Their power lies in huge user bases, thanks to which you can drive targeted campaigns to reach your audiences. It would be best to consider investing in paid advertising to get a broader audience and build brand awareness. Platforms like Google Ads allow for precise targeting, helping you connect with users based on their interests, demographics, and online behaviors.

Implement Email Marketing

A well-executed email marketing strategy can be a powerful tool for nurturing existing relationships and keeping clients informed about new services, updates, and promotions. To leverage the full potential of email marketing, segment your email list to provide tailored content that aligns with each client’s interests and financial goals. Personalized emails that address specific needs can increase engagement and retention rates.

Monitor Compliance and Build Trust

Maintaining compliance is essential in financial digital marketing, as this industry is heavily regulated. Ensure all your marketing materials adhere to industry legislation and maintain transparency to build trust with your audience. Clear language, disclaimers, and secure platforms will help reinforce credibility and keep your campaigns compliant.

Measure and Optimize Performance

To achieve the best campaign results, use analytics tools to monitor the performance of your digital marketing campaigns. Track metrics like website traffic, conversion rates, and social media engagement to assess the effectiveness of your efforts. Regularly reviewing KPIs helps to identify areas for improvement and adjust your strategy as needed to optimize results.

5 Tips in Digital Marketing for Financial Services

The best advice for financial services digital marketing is to meet the target audience’s expectations and ensure a seamless experience. It results in increased customer satisfaction, trust, and loyalty and ultimately leads to better outcomes. The top tips for financial companies’ marketing strategies include focusing on educational content, emphasizing security and trust, using social proof elements, prioritizing personalization, and concentrating on mobile optimization.

With increasing digitization influencing every branch, including the finance industry, digital marketing is crucial for institutions to stay relevant and competitive by meeting consumers’ evolving needs. Yet, each financial marketing strategy requires creative ideas, a strategic approach, and technical skills to bring the desired results.

To achieve your goals effectively, consider the following digital marketing tips for financial services.

1. Focus on Educational Content

Provide valuable educational content to make your audience more likely to engage with your offer. In the financial industry, offers are often complex, making it more difficult for potential customers to make decisions. The key to success is to create informative content, leveraging blog posts, webinars, videos, and infographics to break down complicated topics like investment options, loan processes, or tax strategies. Using straightforward language can effectively facilitate a full understanding of the offer, address potential concerns, and encourage users to take the desired action.

2. Emphasize Security and Trust

Ensure data privacy and security are prominently featured in all marketing materials Since financial transactions and personal data are involved, trust and security are top concerns for customers. To address these objections and increase customer confidence in your services, share information on how you protect customer data, adhere to compliance regulations, and include clear disclaimers where necessary.

3. Use Social Proof Elements

Social proof, such as testimonials and client success stories, can significantly influence potential customers, especially in the finance industry. Showcase reviews from satisfied clients or share case studies demonstrating successful outcomes to impact potential customers’ decision-making. Including recognizable trust symbols, like security badges and industry certifications, you can also reinforce your brand’s credibility and attract new clients.

4. Prioritize Personalization

When developing different offerings, it is important to know that customers in the financial sector value personalized experiences that reflect their specific financial situation and goals. Use data analytics and customer insights to tailor your digital marketing efforts. Tailoring your communications, such as personalized email campaigns and targeted ads, to address individual needs can boost engagement and drive conversions.

5. Concentrate on Mobile Optimization

Ensure that your website, landing pages leveraged in campaigns, content you share, and digital ads you run, are optimized for mobile. A responsive design improves the user experience, making it easy for clients to navigate, access services, and perform actions from their smartphones.

3 Examples of Digital Marketing in Finance

Check out the 3 examples of digital marketing in the finance industry and discover how various businesses leverage the online environment to boost their brand awareness, attract new customers, and keep customer loyalty. Inspire yourself with real-life examples, and learn how to drive successful campaigns.

1. Paid Advertising

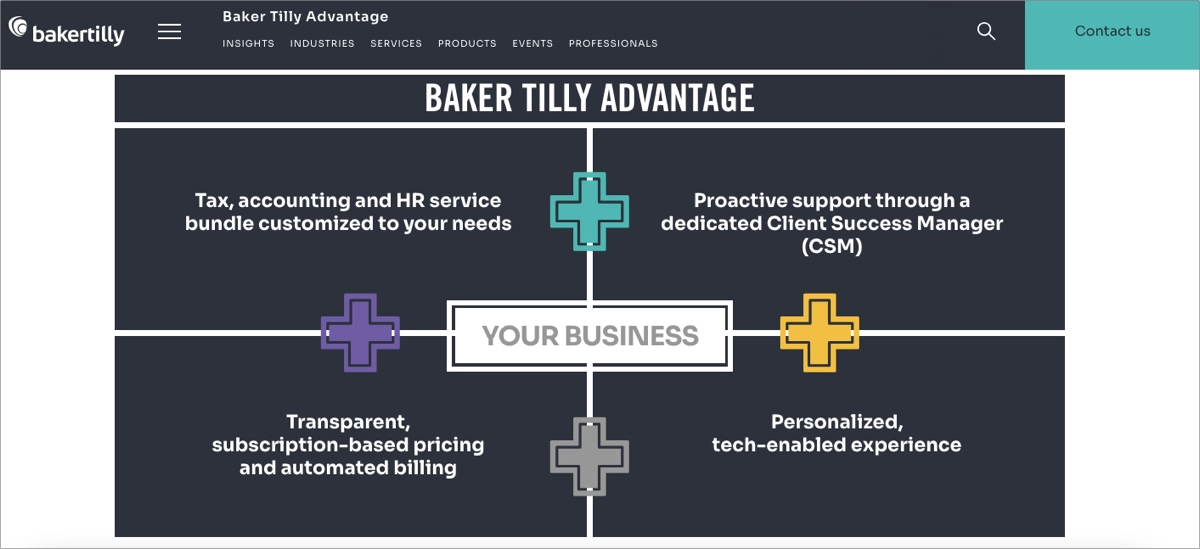

The first example shows a good PPC campaign run by a tax services company. When a user searches for tax advisory in Seattle, the most relevant ads display at the top of SERP. Baker Tilly leveraged well-matched keywords and created short, relevant to their offer ad copy, thanks to which the ad meets user expectations.

Once the ad is clicked, it directs the user to a professionally designed, relevant page, where the company describes its offer and shows all benefits. Thanks to thought-out ad creation and a relevant web page, the ad has a good Quality Score and displays at the top of search results.

This digital marketing strategy is perfect for financial service providers willing to increase brand awareness, drive website traffic, and generate leads. PPC campaigns provide immediate results, making them ideal for quickly reaching potential clients and achieving measurable outcomes.

2. Social Media Marketing

The second example illustrates how social media marketing can effectively promote insurance offers. The company shared a short, informative video on LinkedIn explaining how their life insurance product works, breaking down complex concepts into simple terms for viewers. By using a platform like LinkedIn, they reach a professional audience and target individuals who might be considering life insurance as part of their financial planning.

By sharing a short, engaging video, they showcased innovative and creative ways to explain how their life insurance products work, highlighting key benefits and demystifying the process for potential clients. This approach allowed the target audience to access strategically focused content emphasizing life insurance’s value in an easily digestible format. Using social media as a digital marketing tool helps financial institutions build brand awareness, generate leads, and position themselves as trusted advisors in their sector.

3. Search Engine Optimization

The third example shows SEO marketing techniques that allow financial businesses to position their brands high in search engine rankings, effectively driving organic traffic to their websites or landing pages. By adhering to SEO best practices – such as optimizing for relevant keywords, enhancing site speed, and ensuring mobile-friendliness – U.S. Bank effectively increased its visibility to users actively searching for financial solutions, such as personal loans.

Additionally, by creating quality content that addresses common questions, provides industry insights, and offers practical financial advice, they not only attract organic traffic but also build credibility and trust with potential clients. The U.S. Bank directs users searching for personal loans to a relevant, dedicated landing page where they can directly apply for a loan. The page is not only SEO-friendly but also focused on usability, providing users with the solution they search for.

Ultimately, effective SEO techniques allow businesses in the financial sector to maintain a strong online presence, attract a steady stream of visitors, and convert them into leads or clients without relying solely on paid advertising.

4. Content Marketing

The last example shows content marketing leveraged by a fintech brand, offering an app for crypto payments. Their innovative product answers the growing demand for secure and efficient cryptocurrency transactions, catering to users looking for convenient ways to manage digital assets.

They focus on financial education and provide valuable information on their blog. This fintech brand explains complex topics through blog posts, making them accessible to a broad audience. Leveraging content marketing, they not only attract and educate users but also position themselves as a trusted resource in the fintech space.

This approach effectively builds customer trust and encourages app downloads. Their content strategy focuses on answering common questions, dispelling myths about cryptocurrency, and providing practical tips on how to use their app safely. Content marketing in the finance industry can effectively drive engagement and position the brand as a leader in the market.

Why Is Digital Marketing Important for Financial Services?

Digital marketing enables financial institutions to reach a broader, more targeted audience and engage with clients through personalized, data–driven strategies. Nowadays, consumers increasingly seek financial information and services online, making it crucial for institutions to have a strong online presence.

In contrast to conventional marketing, digital marketing enables the timely delivery of relevant content that informs and fosters trust while improving customer experiences. Leveraging online marketing strategies provides measurable results, allowing financial firms to adjust strategies in real time, optimize spending, and effectively improve customer acquisition and retention.

The financial services industry is one of the most competitive ones – companies have to switch from traditional to online marketing strategies to adjust to the continually evolving market and effectively reach their audiences. According to Statista, the number of Internet users reaches 5.35 billion, which is 67.1% of the world’s population. This shows the huge potential of online marketing and highlights the importance of leveraging digital marketing strategies to increase brand awareness, acquire new customers, and build lasting relationships with customers, also in the financial industry.

What’s the Use of Landing Pages in Digital Marketing for Financial Services?

Landing pages enable financial services to achieve conversion goals in their digital marketing strategies, help build brand awareness, provide valuable content, and more. These standalone pages are designed with a single goal in mind, whether it’s capturing contact information, promoting a specific product, or encouraging sign-ups for financial consultations. Their focused approach makes them perfect conversion points for each type of digital marketing strategy, including email marketing, social media marketing, or PPC advertising campaigns.

For financial services, landing pages can effectively display a specific service, like loans, investment options, or insurance plans, to offer visitors detailed information and persuasive calls to action. These pages can also be leveraged to build trust with strategic elements like client testimonials, security badges, and compliance information, which are essential in an industry where credibility is vital. Additionally, landing pages are great for gathering data about campaign efficiency and tracking user behavior. This allows financial institutions to gather valuable insights into customer preferences and optimize marketing efforts for better results.

As landing pages are crucial for driving successful digital marketing campaigns in financial services, you should meet the Landingi platform that facilitates their creation, testing, and optimization. Designed for marketers, Landingi offers over 400 fully customizable templates and an intuitive builder, thanks to which you can easily craft an attractive page for your campaigns. AI landing page features can help you effortlessly generate educational, engaging, and SEO-optimized content for the entire page. For bigger campaigns, you can use Landingi to craft multi-language pages in minutes – the platform supports 29 languages, allowing you to reach global audiences effectively.

Landingi is a multifunctional platform, so next to a user-friendly builder stuffed with practical features, you can leverage its A/B testing tool to experiment with various page versions and discover your audience’s preferences. EventTracker tool enables tracking events and user behavior across your landing pages, so you can further optimize them for better results. Thanks to over 180 integrations, you can make Landingi a valuable part of your existing marketing toolkit. This platform, offering solutions for conversion optimization and enabling businesses to strengthen their online presence, is a must-have if you want to promote your financial services effectively.

What’s the Use of AI in Digital Marketing for Financial Services?

Financial institutions can analyze extensive customer data through AI–powered tools to obtain insights into behavior, preferences, and trends. This allows them to customize marketing messages and offers for individual clients, thus improving personalization and customer engagement. AI also streamlines customer segmentation, lead scoring, and content recommendation processes, enabling financial marketers to concentrate on high-impact tasks.

Financial services often leverage AI-powered chatbots to improve customer service by offering instant, 24/7 support, addressing queries, and guiding users through their offers. Furthermore, AI assists in predictive analytics, enabling financial institutions to predict customer needs and optimize campaigns, ultimately enhancing customer acquisition and retention.

What Are the Benefits of Digital Marketing for Financial Services?

Digital marketing offers various benefits for financial services, including broader reach, cost-effectiveness, data-driven personalization, improved customer engagement, and measurable results. Unlike traditional marketing, digital strategies enable financial services to target specific demographics precisely, which translates into conducting marketing campaigns that resonate with the right people at the right time.

Online marketing means both greater reach and cost efficiency. Compared to traditional marketing methods, digital marketing allows for better budget control, so financial institutions can easily assess the efficiency of each campaign and allocate resources across these channels that deliver the best ROI. They can easily stop underperforming campaigns to prevent wasted spending, which is hard to achieve in most traditional marketing methods.

Online marketing allows businesses to examine target audiences and their behaviors and determine how they affect campaign success. With data-driven insights, financial services can deliver personalized content and offers based on customer preferences, which increases engagement and satisfaction. Leveraging digital channels like social media, email, and websites helps build stronger relationships with clients.

The most valuable advantage of incorporating online marketing strategies by financial services is measurable results. Digital marketing provides detailed analytics, thanks to which businesses can track each campaign’s performance in real-time. This enables them to make informed decisions, optimize strategies, and achieve better outcomes.

Financial services that decide to use digital marketing strategies can not only attract and retain clients but also build a stronger brand presence in this competitive industry.

What Are the Limitations of Digital Marketing for Financial Services?

While digital marketing offers multiple advantages for financial services, it also comes with a couple of general limitations, such as high competition or rapidly changing technology, and more industry–specific challenges, including strict regulatory compliance and data privacy concerns. It’s not a secret that the financial sector is highly competitive. This might lead to increased costs for digital advertising, especially in paid search. Digital marketing for financial services, when not led with a strategic approach and technical expertise, can strain marketing budgets and make it challenging to achieve a strong return on investment.

Every business that engages in digital marketing must constantly adjust to new technologies and trends due to the rapidly evolving digital landscape. Keeping up can be demanding of resources, especially for institutions with limited flexibility. Financial services are subject to stringent regulations that can limit marketing activities. Ensuring compliance with laws like GDPR and industry-specific guidelines can make creating and deploying digital campaigns more complex and time-consuming. Moreover, handling sensitive financial data online raises privacy concerns. Financial institutions must prioritize data security and transparency, which may limit the extent to which they can personalize marketing efforts without risking customer trust.

However, despite all the limitations, digital marketing with strategically focused content, well-executed paid campaigns, and personalized email marketing can provide exceptional results, affecting substantial growth for businesses in the finance industry.

Drive Business Success with Landingi

Financial institutions must stay flexible and adjust their marketing strategies to meet evolving customer expectations and technological advancements. Embracing digital marketing is no longer a choice but a critical step for institutions aiming for sustainable growth and a competitive advantage.

By focusing on the unique needs of their audience and staying compliant with regulations, financial services can successfully navigate the digital world, build brand credibility, and drive meaningful results for long-term success.

Leverage SEO, content marketing, social media, and email marketing strategies to broaden your financial business reach and enhance customer trust and loyalty. Check out how professionally designed, focused landing pages can help you achieve campaign goals and grow your business – try Landingi now and create high-converting pages for your digital marketing campaigns.